IBBA Honors Top Business Brokers at 2025 Conference

Our team at Rocky Mountain Business Advisors is proud to announce our President Gregg Kunz as one of the winners of the International Business Brokers Association 2024 Chairman’s Circle Award! Gregg has won six awards in the past seven years! The international Business Brokers Association (IBBA) is the world’s largest professional trade association for business brokers. The organization presents awards . . . Read More

Q4 Market Pulse Survey 2024

The Market Pulse Executive Report is a collaboration between The International Business Brokers Association® and M&A Source, created to provide quality information on the market conditions for businesses sold in Main Street and Lower Middle Market to business owners and their advisors. Rocky Mountain Business Advisors brings you exclusive access to select key market information in the 2024 Q4 report—information . . . Read More

Q3 Market Pulse Survey 2024

The Market Pulse Executive Report is a collaboration between The International Business Brokers Association® and M&A Source, providing quality market information on a quarterly basis as the premier source for insight on Main Street and Lower Middle Market Transactions. Rocky Mountain Business Advisors brings you exclusive access to select key market information in the 2024 Q3 report—information typically reserved for . . . Read More

CHAPTERS 11 & 12 : Taking the Final Steps to Sell Your Business: Securing Your Legacy and Transitioning Leadership Responsibilities

Before you exit your company, it is important to transition the leadership role over to the new head of the company. Gregg Kunz discusses how to secure your legacy and transition leadership responsibilities and more in the final two chapters of “Lucrative Exits.” When you leave a company it can still have a lasting impact, which is where entrusting a . . . Read More

CHAPTERS 9 & 10: Discover These Financial and Legal Insights, and What to Expect on Closing Day

What should you expect on the closing day of your business? And what insights are needed for your business’s finances and legal responsibilities before closing day? Gregg Kunz discusses these topics and more in the latest two chapters of “Lucrative Exits.” Learn more about what exactly is needed before the final closing of your business’s sale, and what obligations you . . . Read More

CHAPTERS 7 & 8: Negotiating the Best Terms, and Understanding Financing for a Win-Win Business Sale

Negotiating a business sale can be a delicate process. Striking a deal that benefits both the buyer and the seller is key to ensuring long-term success. In his book “Lucrative Exits,” Gregg Kunz explores strategies for negotiating a win-win business sale. Creative financing options, understanding seller financing, and leveraging available financial tools are also discussed as a critical component to . . . Read More

CHAPTERS 5 & 6: Presenting Your Story: Identifying and Enticing Probable Buyers, and The Importance of Crafting Your Business Story

In “Lucrative Exits,” Gregg Kunz dives deep into two game-changing elements of selling your business: identifying and engaging with your most probable buyer, and creating your personal business story. He masterfully drives the discussion on why knowing your ideal buyer is crucial to navigating negotiations and achieving the best possible outcome, while emphasizing the impact of a well-told business story. . . . Read More

CHAPTERS 3 & 4: Maximizing Your Business Sale: Building the Right Team and Accurately Pricing Your Business

Selling your business is one of the most significant decisions you’ll ever make. It’s not just about finding a buyer; it’s about getting the best possible outcome—both financially and for your legacy. In the latest chapters of “Lucrative Exits,” Gregg Kunz, founder of Rocky Mountain Business Advisors, shares essential strategies for making the most of your business sale. Read through . . . Read More

CHAPTERS 1 & 2: Preparation Meets Opportunity: The Key to a Lucrative Exit

It is important to understand market dynamics when selling a business, recognizing the right moment, and aligning with buyer motivations. The decision to sell can be one of the most pivotal in a business owner’s life, encompassing not just financial gain, but also the continuation of your legacy and the future of your team. Yet, the complexities of market timing . . . Read More

INTRODUCTION: Envisioning Your Successful Exit

Selling a business can be one of the most significant decisions in a business owner’s life. It’s not just about the financial gain but also about preserving the legacy you’ve built, ensuring the well-being of your team, and finding the right buyer. However, the process can seem overwhelming, leading many to procrastinate. Gregg Kunz, author & expert business broker’s new . . . Read More

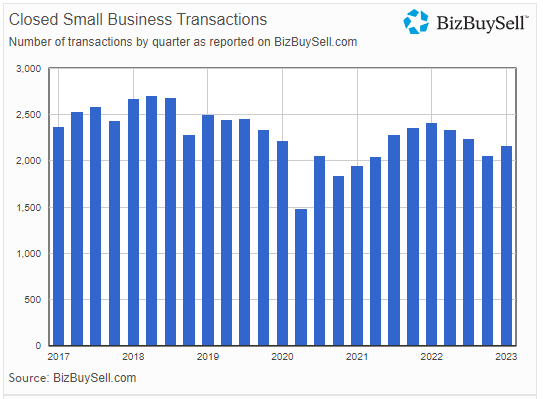

Navigating the Surge in Small Business Acquisitions in 2024

The small business acquisitions landscape has reached a significant milestone in the second quarter of 2024, marking a 5% growth over the past year and a 3% increase from the previous quarter. According to BizBuySell’s Insight Data, which meticulously tracks U.S. business-for-sale transactions and sentiments from owners, buyers, and brokers, a total of 2,448 businesses were sold, amounting to an . . . Read More

Rocky Mountain Business Advisors’ Definitive Guide for Sellers

Rocky Mountain Business Advisors’ success in selling over 97% of the businesses we bring to market is based on a process. A process that has proven itself over many years and outlined in this Definitive Guide for Sellers. . . . Read More

2024 International Business Brokers Association (IBBA) Recognizes Rocky Mountain Business Advisors

FOR IMMEDIATE RELEASE JUNE 11TH, 2024 (Louisville, Kentucky) The International Business Brokers Association (IBBA) has recognized Gregg Kunz with the Chairman’s Circle Award for outstanding performance in 2023 as part of its Member Excellence Awards Program. This is the third year in a row that Mr. Kunz has been a recipient of this award, which is presented to less . . . Read More

Axial Middle Market Review

Axial is one of the many marketing companies Rocky Mountain Business Advisors uses to ensure each of our client’s success. Nick Coetzee, of Axial, has recently written an article discussing the Middle Market Review. At Axial, we’re fortunate to have access to a unique data set of deals closing in the lower middle market. In today’s article, we asked ourselves the question, . . . Read More

ColoradoBiz: The Best of Colorado 2023 Edition

ColoradoBiz has released its annual “The Best of Colorado” publication. In its 2023 edition, Rocky Mountain Business Advisors has been recognized by ColoradoBiz as the first runner-up in the Best Valuation Consulting category. Businesses, as mentioned by ColoradoBiz; “They have found a way to perfect their craft, grow their brand and be recognized for their specialization. They have scaled the . . . Read More

The International Business Brokers Association (IBBA) Recognizes Rocky Mountain Business Advisors

FOR IMMEDIATE RELEASE JUNE 5TH, 2023 (DENVER, CO) Gregg Kunz, Denver Business Broker, and leader of the Rocky Mountain Business Advisors team, has once again been recognized for his outstanding performance in 2022 as part of the IBBA’s Member Excellence Awards Program for the Chairman’s Outstanding Producer Award! “The transition of business ownership between buyers and sellers is an . . . Read More

Q1 2023 Year-End Insight Report

BizBuySell Insight Report Volume of small business acquisitions moved up 4.8% in the first quarter of 2023 over Q4 of 2022 and after three consecutive quarterly declines. While transactions are 10% below the previous year, median sale prices are up 1.4%, and 11% over the previous quarter, according to BizBuySell’s Insight Report, which tracks and analyzes U.S. business-for-sale transactions and . . . Read More

Business Value Determination – The Impact of Personal Expenses When Selling

Main Street and Premier Main Street business values normally use SDE (Seller Discretionary Earnings) and an industry multiple range, the ‘Multiple’ in determining the likely sales price range for a sale to a third party. Far too often business owners believe that they can add back all personal expenses to the net income number which creates real problems when they are ready . . . Read More

The International Business Brokers Association Recognizes Rocky Mountain Business Advisors

(DENVER, CO) The International Business Brokers Association (IBBA) has recognized Denver Business Broker, Gregg Kunz, with the Chairman’s Outstanding Producer Award for outstanding performance in 2021 as part of its Member Excellence Awards Program. “Business Brokers play a vital role in sustaining our economy by facilitating the successful transition of business ownership between sellers and buyers,” stated IBBA Executive . . . Read More

Capital Gains Tax Increase Signals Business Owners to Sell Now

If you’re looking for a sign to sell your business, this is it. While the newly released tax plan increases capital gains tax by less than expected, business owners who are looking to sell remain encouraged to do so now—but why? Rocky Mountain Business Advisors explains the ideals of the situation and why owners should act fast to get their . . . Read More

Boomers Cause Real Estate Boom

The current business-selling marketing is booming—and we have baby boomers to thank. Between the years 1946 and 1964, there was a sudden increase in births in the United States. Many who had put off starting a family through the Great Depression and World War II now saw an opportunity to do exactly that, prompting 76 million babies to be born . . . Read More

Paying the Piper – The Impact of an Increased Capital Gains Tax Rate When Selling Their Business

The question of who will lead America for the next four years is no longer a mystery however there are questions regarding changes to the tax code. President Biden has publicly and repeatedly stated his desire to increase the long-term capital gains tax rate. Make no mistake, the increase is coming, and the unknowns are how much the rate will . . . Read More

How to Determine the Value of a Small Business for Sale in Colorado

If you have a small business for sale in Colorado, now or in the future, you need to know what your business is worth. While there are some basic steps to follow, all business valuations are unique. Adding up capital assets isn’t a business valuation. A buyer isn’t interested in selling your assets, rather it is the cash flow that . . . Read More

What’s Wrong With This Business?

I am thankful to be among our industry’s most successful Business Brokers and one key to my success in unlocking the highest value for my clients is addressing buyer concerns. Successful brokers can anticipate and provide accurate answers to questions posed by serious prospective buyers. Uncovering the facts is part and parcel of our profession and because most buyers are . . . Read More

Considering the sale of your business in 2021? The U.S. Government is going to help!

In previous articles we have discussed why selling a business in 2021 may be the best time to sell. With the federal government’s recent passing of the $900 billion Stimulus Bill major changes will be coming to the SBA 7a lending program. Will this be good news for Sellers and/or Buyers? Indeed, this will be good news for both parties . . . Read More

The Tax Implications of Selling a Business Explained

When a business is sold to an individual, both the seller and buyer will have tax implications. If you’re thinking of buying or selling a business in the near future, keep these tax considerations in mind. You’ll need to look at the structure of the company to decide the best way to proceed. Generally, the seller is focused on increasing . . . Read More

What is an Asset Sale versus a Stock Sale?

If you’re thinking of buying or selling a business, you may be wondering about the difference between an asset or a stock sale. Determining the type of sale for selling your business is extremely important. An asset sale purchases a specific detailed list of business assets and liabilities. A stock sale requires buying the owners’ share of stock in the . . . Read More

Why is Working Capital Important in a Business Sale Transaction?

The calculation of working capital requirements can be a little cumbersome, and as such it’s a topic that many business owners have a problem grasping. Working capital is the “blood” of a business and measures liquidity to indicate the company’s short-term health. It is the cash that the business must have on hand to pay its current liabilities. These include . . . Read More

A Storm Warning: Preparing Your Business for Sale in Advance of the Seller Tsunami

Unlike an unexpected earthquake which produces a devastating Tsunami without warning, the Seller Tsunami is one that we have advanced warning for. What does it mean for business owners planning their exit to sell their business? Quite simply the Seller Tsunami refers to the large number of Baby Boomer-owned businesses which will be sold in the coming years. The Baby Boomer . . . Read More

How to Begin Planning for Life After the Sale of Your Business

Business owners, like most people, generally do not have a written plan for their future. They under-plan their personal affairs even more egregiously than their business affairs at a time where planning is becoming more important than ever. Planning your exit begins with planning for your future life after the sale of your business. The following are some tips for . . . Read More